Fewer Restrictions. More Possibilities!

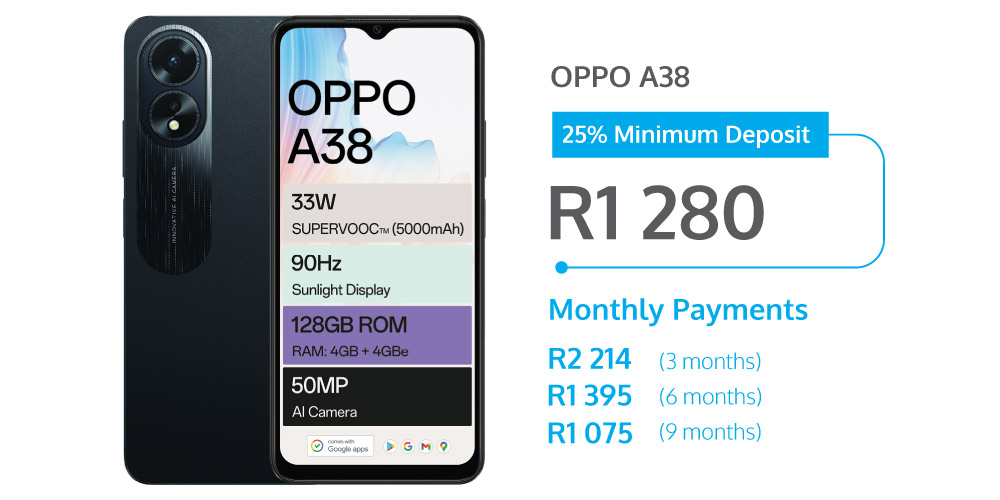

Qualify to buy a smartphone without a credit card and pay weekly over 3-9 months. Even with no bank account or formal credit history, PayJoy users can access financial services and carve a route into the financial system.

Frequently Asked Questions

With just your valid SA ID book, Proof of address no older than 3 months, SA phone number, email and a deposit amount, we will approve your application fast.

Rather than charge an interest rate or markup, the retailers simply withhold discounts for consumers who want to pay monthly.

PayJoy turns your phone into virtual security collateral. If you are late paying, you won’t be able to use your phone – this lets us offer you a low cost of financing with no late fees.

PayJoy does do a credit score check. Because your phone acts as a credit guarantee, the entrance-level requirements are low. You don’t even need a bank account. The initial deposit amount may vary according to your credit profile.

In case of any default, the device shall be locked, with the inherent consequences that this involves, such as the impossibility of partial or total access to the device. Thie will be removed once the account is in good standing.

Your PayJoy device will be permanently unlocked after it has been paid in full.

Yes, by making regular, on-time payments, customers will establish a credit history and improve their credit score.