As we all get to grips with starting the working year ahead, I would like to take a look at what the future holds for the mobile phone brands in South Africa. Traditionally, December is our busiest month where we sell the most mobile devices for the year. December 2018, however, was somewhat muted and we found some interesting trends carrying us into the new year.

So how are the big three (Apple, Samsung and Huawei) doing and what’s their outlook looking like for 2019? With our economy not having a stellar time, we have picked up two clear patterns emerging, with South African consumers, looking at their next mobile phone purchase:

Firstly, they are shopping down (or sticking to a tight budget range). The aspirational drive to have the “latest” top of the range model is in decline.

Our Top 10, handset sales for the December period is a testament to this with our top seller being the Huawei P20 Light. Across all brands, manufacturer “flagship” phones were massively out-sold by the mid-tier cousins. In the past, consumers would be more willing to splash out to acquire the latest and greatest, with lesser device variations largely ignored.

Secondly, customers are opting to hold on to their existing mobile phones and are instead optimising their monthly contract spend with reduced rates on “no device” contract deals.

So, other than a stalling economy, what has changed? Our sales trends and customer feedback show a few factors influencing the purchasing behaviour, which I will touch on.

Price: This probably has the most significant influence on purchasing behaviour currently. With new flagship phones ranging from R17 000 to over R30 000 on prepaid OR between R800 and R1000 per month on a low-value contract deal (offering little to no data or calls), consumers are finding it extremely difficult to justify the massive premium.

Technology: In the past, each new handset release used to herald some great NEW feature. If you weren’t able to utilise/ show off your new tech, you felt you were left behind. In today’s phone landscape, however, the majority of us use our phones for 4 or 5 essential apps – WhatsApp, Instagram, Facebook, Banking and one or two others. There is no need to have the latest tech to keep up. If the camera is good enough to make your social media posts look lit, you are winning. The gap between a mid-tier and flagship phone has shrunk and is no longer a debilitating choice.

Style: this probably is the most glaring change in handset development. In days gone by when you put your new iPhone 6 (new shape) or Samsung S6 Edge (curved screen) on the coffee shop table, next to any previous version, the new designs were instantly recognisable. You could be the envy of your friends by displaying your new social enabler at Bootleggers in Sea Point. Today, however, handset designs have all but morphed into one. So much so that it’s hard to tell your Samsung A7 from your S9, your Huawei P20 from your Y7, your Apple X from your XR and heaven forbid your Apple from a Huawei.

So where do the handset companies go from here?

Both Samsung and Apple have had a disappointing end to 2018. The start to 2019 shows no change, with both leading manufacturers displaying flagging sales and ever stiffer competition from Chinese manufacturers.

Apple’s issues are largely by their own design and, I feel, they have finally reached the tipping point. Their business model, in the past, was to create hype around their new devices, starve supply and drive demand like no other. Every 2nd model in the product life cycle would go through a complete design change and, coupled with a few new software features which could only be used on the new models. They drove the “upgrade” cycle – with annual updates but, if your iPhone got to two generations old, you were seriously behind. If you had the iPhone 5, you would not get the 5S you would wait for the iPhone 6. If you had the 6S, why get the 7? You would wait for the iPhone 8. Their strategy tied in perfectly with the 24-month contract/ upgrade cycle.

Then things started to change; we lost the 3.5mm jack, and we hesitated. We lost fingerprint unlocking, so we waited even more. It felt like we were getting less but expected to pay more for the privilege of having a “better” design. We started questioning what the actual hardware “upgrades” were and were they even worthwhile? My iPhone 7 Plus works great, I won’t get the X, let me rather wait for the XS. The XS arrives, but the price is so much more than I am paying for my 7 Plus. Can I justify the upgrade? Maybe I should go with the more affordable XR – but it just has a single camera. Why should I pay more and get less? My choice is simple.

For a long period, the Apple ecosystem created the stickiness that bound users into getting the next iPhone, “but all my music is on iTunes” OR, “how will I share all my photos” and now with Apple expanding its content services to include Amazon and Samsung have they removed this glue?

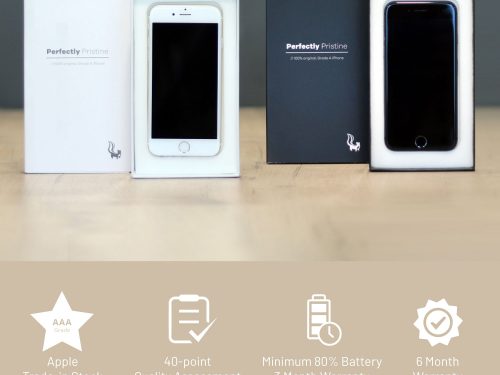

Finally, for Apple, the devices generally are pretty robust, and with more and more reputable repair outlets providing battery replacements for your old iPhone you can easily extend the life of your devices for a few more years.

For Samsung, the problem has been around for the past 6 or 7 years. Because their desire to dominate the industry is embedded in the corporate culture, the product line and range is there to squeeze out all potential competition. By covering every single product niche with a model, you don’t create many gaps for your competitors to muscle in. Their short-sightedness of this approach has however meant that they cannibalise their market across their ranges.

From a marketing perspective, the focus has always been on their premium devices, and the myriad of other are left to find their own space in a flooded market. On the flagship side, they have had a similar problem as with Apple. For 2019 though, they will be unveiling a foldable screen phone which will herald a real innovation in the industry but when you look at those 3 or 4 essential apps again how do you build a camera into a foldable design? So, while flexible screens are great for media consumption, will they be a hindrance in media creation?

The main problem for Samsung has been their product range, and while they have been trying to reduce the size of the product portfolio the gaps between models in just so small, it makes it easier to shop down. Design and tech have become so similar across models that it’s hard for me to tell one device from another, and I work in the industry – heaven help a poor consumer. If you had to lay out a Samsung J8 and A8 (R80 per month price difference) or a J6 and A7(R150 per month price difference), you will be hard pressed to spot the difference. To be fair the A7 has three cameras and is far superior, but you get my point.

If BMW used the same body for its X1 /X2 and X3 models, and you couldn’t tell them apart, and they all performed equally well in your city commute… Would you buy the cheaper X1 or pricey X3?

Finally, Huawei, they have been a dominating force, in our channel, over the last year. Much like Hyundai, when it first appeared in South Africa, people viewed the brand with scepticism, but over time they have proven they are a solid proposition in the market. Initially, Huawei focused heavily on the lower and mid-tier market which, in hindsight, was a masterstroke (whether by design or pure chance) as they established themselves as a reliable brand that produced quality devices and reasonable pricing. They have slowly pushed into the premium sector and now are contending and even surpassing the big two (Samsung and Apple) in the flagship space.

In general, Huawei offers incredible value for their price points. They are however beginning to make the mistake Samsung made – an ever-expanding product portfolio. For now, this is mitigated by a good pricing glide strategy but, it is a tight rope to walk with the ever-present cannibalisation threat.

So, for 2019, Apple has already started shifting its focus from hardware to expanding its iTunes and Apple TV partnerships to incorporate the likes of Amazon (Alexa) and Samsung (Smart TV). Is this their fundamental shift in strategy to make up for lagging handset sales?

Samsung is heavily reliant on selling components like screens and memory to the likes of Apple and Huawei to help fund its R&D and drive down the costs of innovation, with Apple sales slowing down will we see a far more measured approach to new product launches in 2019 and beyond?

And, finally, with Huawei is the global furore around 5G and security of Huawei built networks in the USA and Europe and their devices being banned in some countries, going to see them increasing their aggressive push into Africa?

The last quarter of 2018 highlighted these changes in consumer spending. The cellular market is brutal – look at the likes of Ericsson, Motorola, BlackBerry and even (the now reborn) Nokia. Will the big three stick to their guns? Will their plans for 2019 be successful? Or, is this an opening for a new company to challenge the status quo? We are excited, are you?

By: Chris Henschel